How to Pay BIR Thru GCash in 7 Easy Steps

How to pay BIR thru Gcash is becoming a common inquiry especially now that we have to be wary of going to places where there might be a crowd because of the pandemic. In this article, we will go through the step-by-step process of how to pay BIR online in only seven steps.

Getting in line at the Bureau of Internal Revenue District offices can be time-consuming especially when the deadline for the tax returns is looming. The long lines and unbearable heat may hinder smooth transactions and cause inconvenience for both the taxpayers and government employees. Still, we have to accomplish our responsibility as taxpaying citizens.

The emergence of the pandemic has forced all establishments, including government institutions to devise new ways to continue operations and serve the public while following the minimum public health standards. Thankfully, the existence of mobile wallet platforms now allows us to be able to settle our dues in the comfort of our homes. There are different ways on how to pay BIR online and GCash is one of the easiest platforms you can do so. Without further ado, here are the seven easy steps on how to pay BIR thru GCash.

How to Pay BIR thru GCash

Pay BIR thru GCash by following the steps below:

Step 1: Download GCash

Before you can pay BIR thru GCash, you first need to download and install the GCash app on your smartphone. GCash is available for iOS and Android users.

If you don’t have an account yet, you can easily register here.

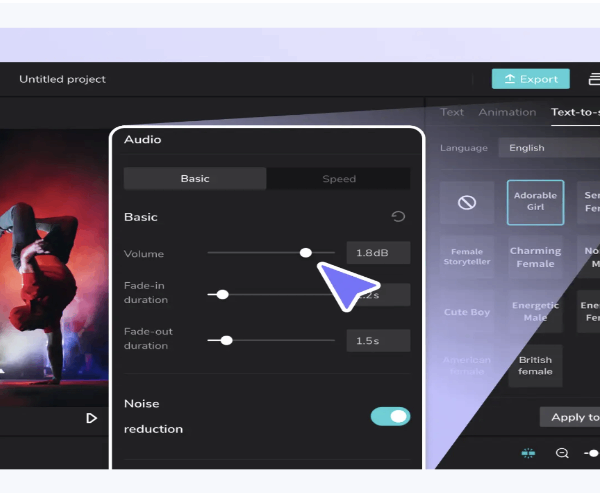

Step 2: Log into the GCash App with your PIN

Step 3: Make sure you have sufficient funds in your GCash wallet

Before paying, make sure your wallet contains the adequate amount needed to pay for your BIR taxes. You can also cash in on GCash in different ways.

Step 4: Pay Bill

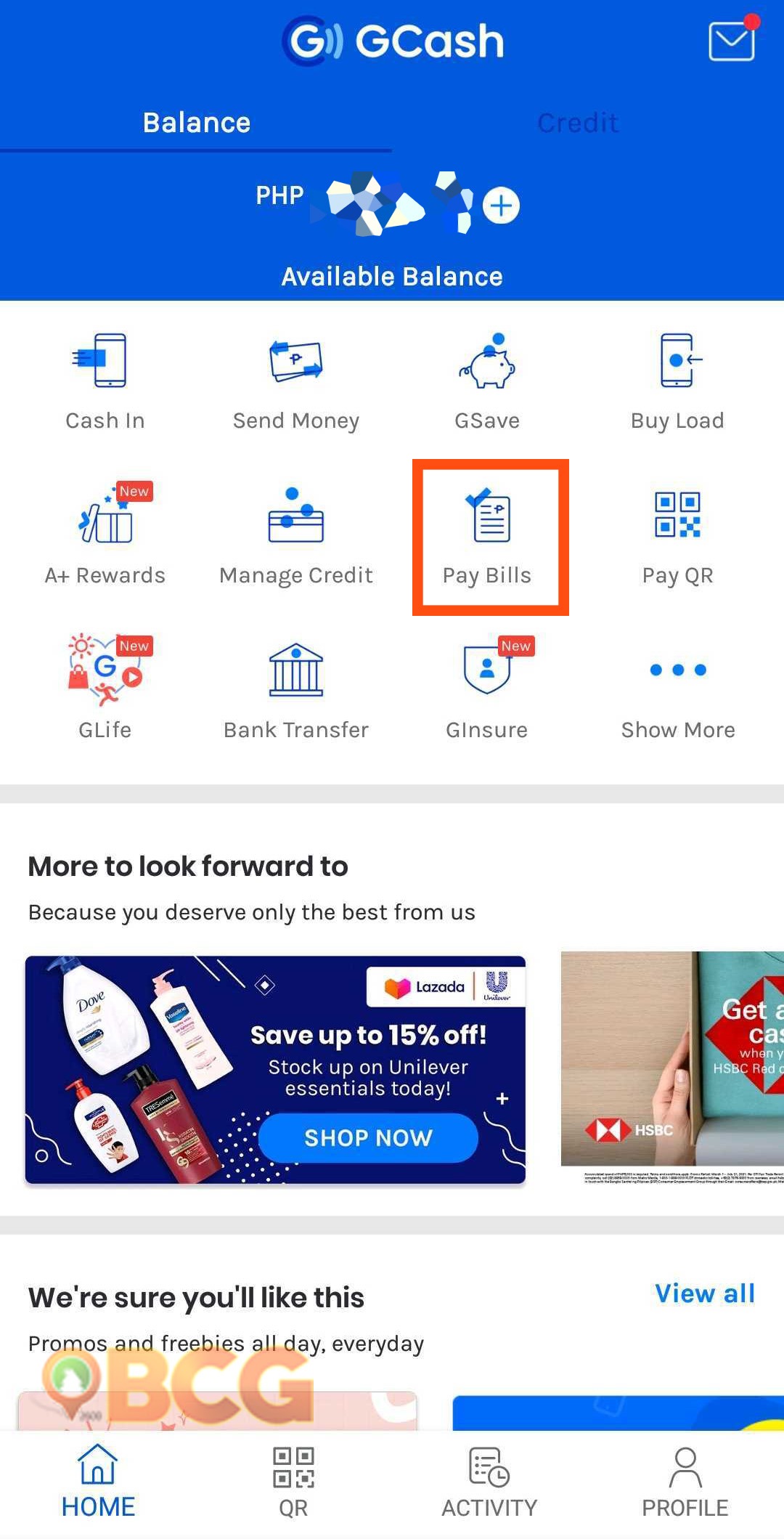

- On your GCash dashboard, select “Pay Bills.”

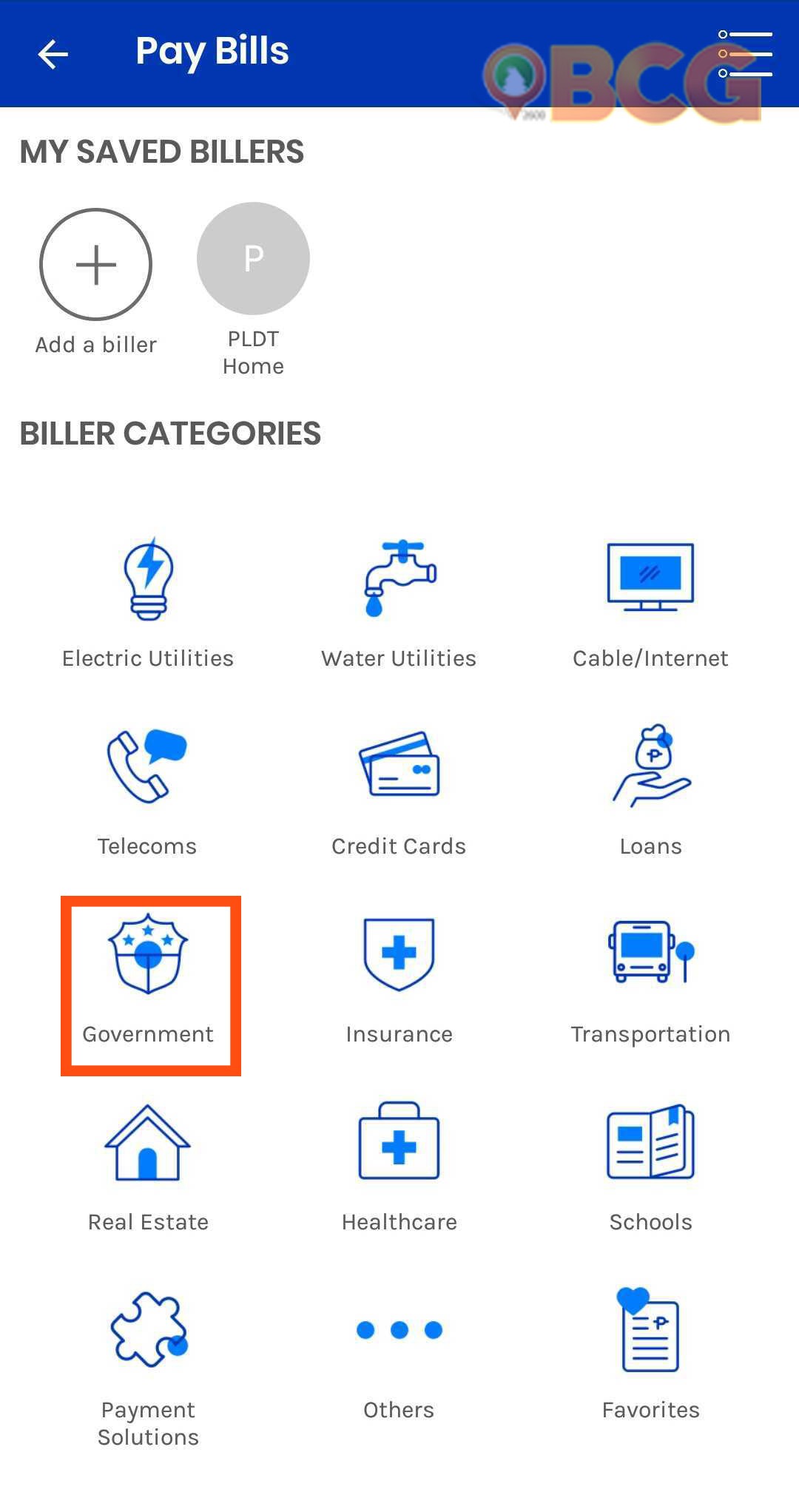

- Under biller categories, choose “Government”

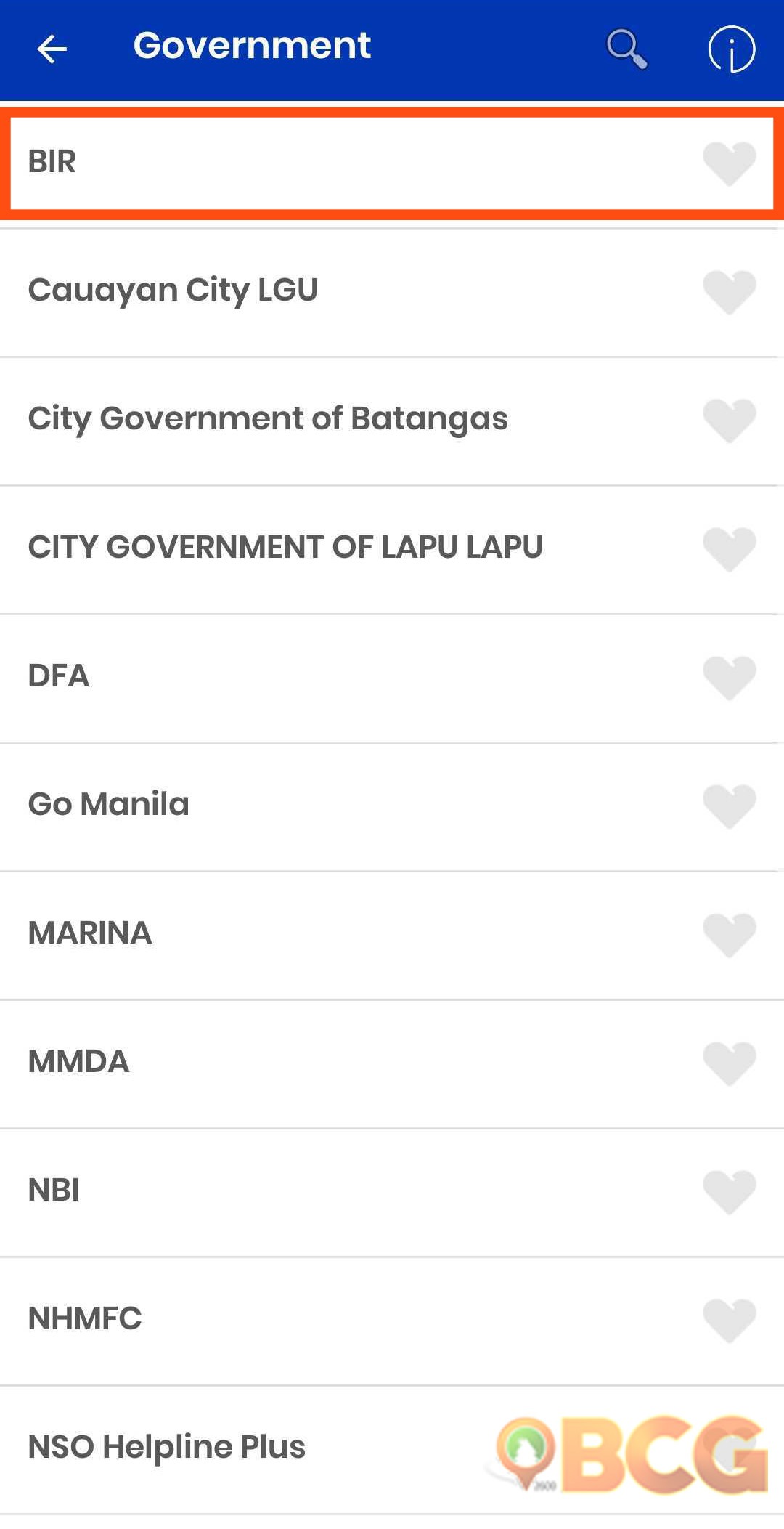

- And finally, choose “BIR”

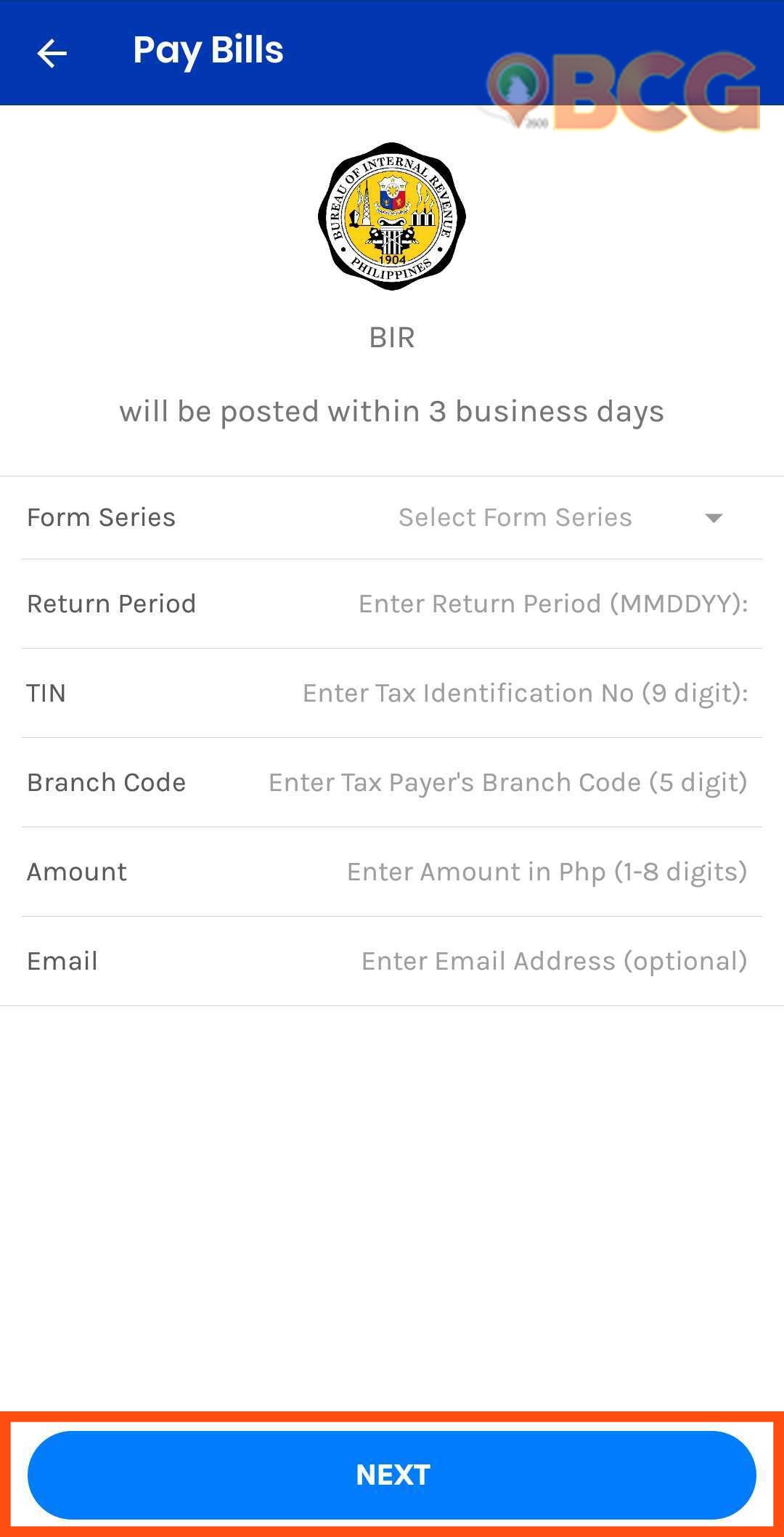

- You will be redirected to the BIR Payment form for your payment details.

Step 5: Accomplish BIR Payment Form

Fill up the following fields correctly:

- Form Series – The form series your payment form is classified under. You may refer below to find out which form series your form belongs to.

- Return Period – The Return Period is the last day of the taxable period of the Tax Return you’re filing.

For example, if you are paying for the April-June Quarter of 2021, the return period will be June 30, 2021. - TIN – the first 9 digits of your Tax Identification Number

- Branch Code – BIR Branch code refers to the 3-5 digits after your TIN. For example, if your TIN is 123-321-456-000, your actual TIN is 123-321-456, and your Branch Code will be 000, which is usually the case for individual taxpayers. Since GCash needs 5 digits, simply add two zeros before your branch code and enter “00000”.

- Amount – your total payment due

- Email (optional) – input your email address if you want to receive a copy of the transaction receipt. This comes in handy as you will need the Transaction Code or Reference Number for when you will file your tax return online.

Once you have filled up all of the details, click “Next“.

Step 6: Confirm the details of your payment

Review your payment details and once you are sure you have entered them correctly, click “Confirm.”

Step 7: Payment Successful

Upon clicking Confirm and the payment goes through, you will be redirected to a screen notifying that GCash has already received your payment along with your Reference Number. You will also be notified via SMS on the mobile number you used for your Gcash account. You may also save a copy of your transaction to your smartphone’s Photo Gallery by clicking the download button on the upper right corner of the screen.

Now that you have successfully paid your tax return, you may now electronically file through the BIR eFPS portal where you will input your payment Reference Number.

Payments will be posted within the next three (3) business days, especially for payments made on weekends.

How to Pay BIR thru GCash: Fees

According to GCash’s website, paying BIR through GCash is currently FREE OF CHARGE.

How to Pay BIR thru GCash: Transaction Limit

Gcash only allows a limit of Php 50,000.00 per transaction in Pay Bills. If your amount due exceeds 50,000.00, you may divide your transactions as long as the payment details are similar so that they will be properly posted to BIR, with your GCash wallet limit in mind.

BIR Payments Accepted thru GCash

GCash accepts payments for the following BIR Form Series:

| Form Series | Form Number | Form Title |

|---|---|---|

| 0600 (Payment Form) | 0605 | Payment Form |

| 0611-A | Payment Form Covered by a Letter Notice |

|

| 0613 | Payment Form Under Tax Compliance Verification Drive/Tax Mapping | |

| 0619-E | Monthly Remittance Form for Creditable Income Taxes Withheld (Expanded) | |

| 0619-F | Monthly Remittance Form for Final Income Taxes Withheld | |

| 0620 | Monthly Remittance Form of Tax Withheld on the Amount Withdrawn from the Decedent's Deposit Account | |

| 1600 (Payment Form) | 1600-VT | Monthly Remittance Return of Value-Added Tax Withheld |

| 1600-PT | Monthly Remittance Return of Other Percentage Taxes Withheld |

|

| 1600-WP | Remittance Return of Percentage Tax on Winnings and Prizes Withheld by Race Track Operators | |

| 1601-C | Monthly Remittance Return of Income Taxes Withheld on Compensation |

|

| 1601-EQ | Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded) |

|

| 1601-FQ | Quarterly Remittance Return of Final Income Taxes Withheld |

|

| 1602Q | Quarterly Remittance Return of Final Income Taxes Withheld On Interest Paid on Deposits and Yield on Deposit Substitutes/Trusts/Etc. |

|

| 1603Q | Quarterly Remittance Return of Final Income Taxes Withheld on Fringe Benefits Paid to Employees other than Rank and File |

|

| 1604-C | Annual Information Return of Income Taxes Withheld on Compensation |

|

| 1604-F | Annual Information Return of Income Payments Subjected to Final Withholding Taxes |

|

| 1604-E | Annual Information Return of Creditable Income Taxes Withheld (Expanded)/ Income Payments Exempt from Withholding Tax |

|

| 1606 | Withholding Tax Remittance Return For Onerous Transfer of Real Property Other Than Capital Asset (Including Taxable and Exempt) | |

| 1621 | Quarterly Remittance Return of Tax Withheld on the Amount Withdrawn from Decedent's Deposit Account |

|

| 1700 (Income Tax Return) | 1700 | Annual Income Tax Return For Individuals Earning Purely Compensation Income (Including Non-Business/Non-Profession Related Income) |

| 1701 | Annual Income Tax Return For Individuals (including MIXED Income Earner), Estates and Trusts |

|

| 1701A | Annual Income Tax Return For Individuals Earning Income PURELY from Business/Profession (Those under the graduated income tax rates with OSD as mode of deduction OR those who opted to avail of the 8% flat income tax rate) | |

| 1701Q | Quarterly Income Tax Return for Individuals, Estates and Trusts |

|

| 1702-RT | Annual Income Tax Return For Corporation, Partnership and Other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate | |

| 1702-EX | Annual Income Tax Return For Corporation, Partnership and Other Non-Individual Taxpayers EXEMPT Under the Tax Code, as Amended, [Sec. 30 and those exempted in Sec. 27(C)] and Other Special Laws, with NO Other Taxable Income |

|

| 1702-MX | Annual Income Tax Return For Corporation, Partnership and Other Non-Individual with MIXED Income Subject to Multiple Income Tax Rates or with Income Subject to SPECIAL/PREFERENTIAL RATE |

|

| 1702Q | Quarterly Income Tax Return for Corporations, Partnerships and Other Non-Individual Taxpayers |

|

| 1704 | Improperly Accumulated Earnings Tax Return For Corporations |

|

| 1706 | Capital Gains Tax Return for Onerous Transfer of Real Property Classified as Capital Asset (both Taxable and Exempt) |

|

| 1707 | Capital Gains Tax Return for Onerous Transfer of Shares of Stocks Not Traded Through the Local Stock Exchange | |

| 1707-A | Annual Capital Gains Tax Return for Onerous Transfer of Shares of Stock Not Traded Through the Local Stock Exchange | |

| 1709 | Information Return on Transactions with Related Party (Foreign and/or Domestic) | |

| 1800 (Transfer Tax Return | 1800 | Donor's Tax Return |

| 1801 | Estate Tax Return |

|

| 2000 (DST Return) | 2000 | Monthly Documentary Stamp Tax Declaration/Return |

| 2000-OT | Documentary Stamp Tax Declaration/Return (One-Time Transactions) | |

| 2200 (Excise Tax Return) | 2200-A | Excise Tax Return for Alcohol Products |

| 2200-AN | Excise Tax Return for Automobiles and Non-Essential Goods |

|

| 2200-C | Excise Tax Return for Cosmetic Procedures |

|

| 2200-M | Excise Tax Return for Mineral Products |

|

| 2200-P | Excise Tax Return for Petroleum Products |

|

| 2200-S | Excise Tax Return for Sweetened Beverages |

|

| 2200-T | Excise Tax Return for Tobacco Products |

|

| 2500 (Percentage Tax and VAT) | 2550M | Monthly Value-Added Tax Declaration |

| 2550Q | Quarterly Value-Added Tax Return |

|

| 2551Q | Quarterly Percentage Tax Return |

|

| 2552 | Percentage Tax Return for Transactions Involving Shares of Stock Listed and Traded Through the Local Stock Exchange or Through Initial and/or Secondary Public Offering |

|

| 2553 | Return of Percentage Tax Payable Under Special Laws |

For Inquiries

For more questions and concerns, you may contact the following:

Bureau of Internal Revenue RDO No. 8

Address: No. 69 Leonard Wood Road, Baguio City

BIR Baguio Contact Numbers:

- (074) 442-2328

- (074) 444-5518

- (074) 443-5850

- (074) 304-1499