Scam Alert: Top 8 Emerging Scams to Watch Out for in the Philippines

Online scams have become more sophisticated and prevalent over the years, and it’s important to be vigilant and protect yourself from falling victim to these schemes. In this article, we’ll discuss some of the most common scams in the Philippines and provide tips on how to avoid them.

Scams in the Philippines

Investment scams

Investment scams promise high returns on investments with little to no risk. The scammers may claim to be associated with a legitimate financial institution or government agency, or they may have fake websites and documentation to make their offer seem legitimate.

Investment scams can also include cryptocurrency scams, where scammers convince people to invest in fake or fraudulent digital currencies or initial coin offerings (ICOs). In these scams, the scammers may promise high returns on investments and may use persuasive tactics to make their victims believe that they will get rich quickly by investing in a particular cryptocurrency. Once the victim invests in the fake cryptocurrency, the scammers will often disappear with the money, leaving the victim with no way to recover their investment. In other cases, the scammer may continue to manipulate the victim, asking for more money or promising to help them recover their investment, but ultimately stealing even more money from the victim.

To avoid falling for investment scams, be cautious of unsolicited offers, do your own research on the investment opportunity, and verify the legitimacy of the company or individual offering the investment. It would also be best to monitor advisories by the Securities and Exchange Commission for investment scammers.

Job scams

Job scams offer work-from-home or easy job opportunities, with upfront fees or the requirement to purchase expensive equipment or training. Scammers may use job posting sites, social media, or emails to offer job opportunities that require little experience or skills. Victims may be required to pay for training or equipment before starting work, only to find that the job does not exist.

Screenshots of some job text scams I have personally received.

Online shopping scams

Online shopping scams involve fraudulent websites or sellers who offer products for sale but never deliver them. Some also claim they sell legitimate items, but will deliver knockoffs. The scammers may also steal personal information or payment details.

To avoid online shopping scams, only shop from reputable websites and sellers, be cautious of deals that seem too good to be true, and verify the legitimacy of the website and seller.

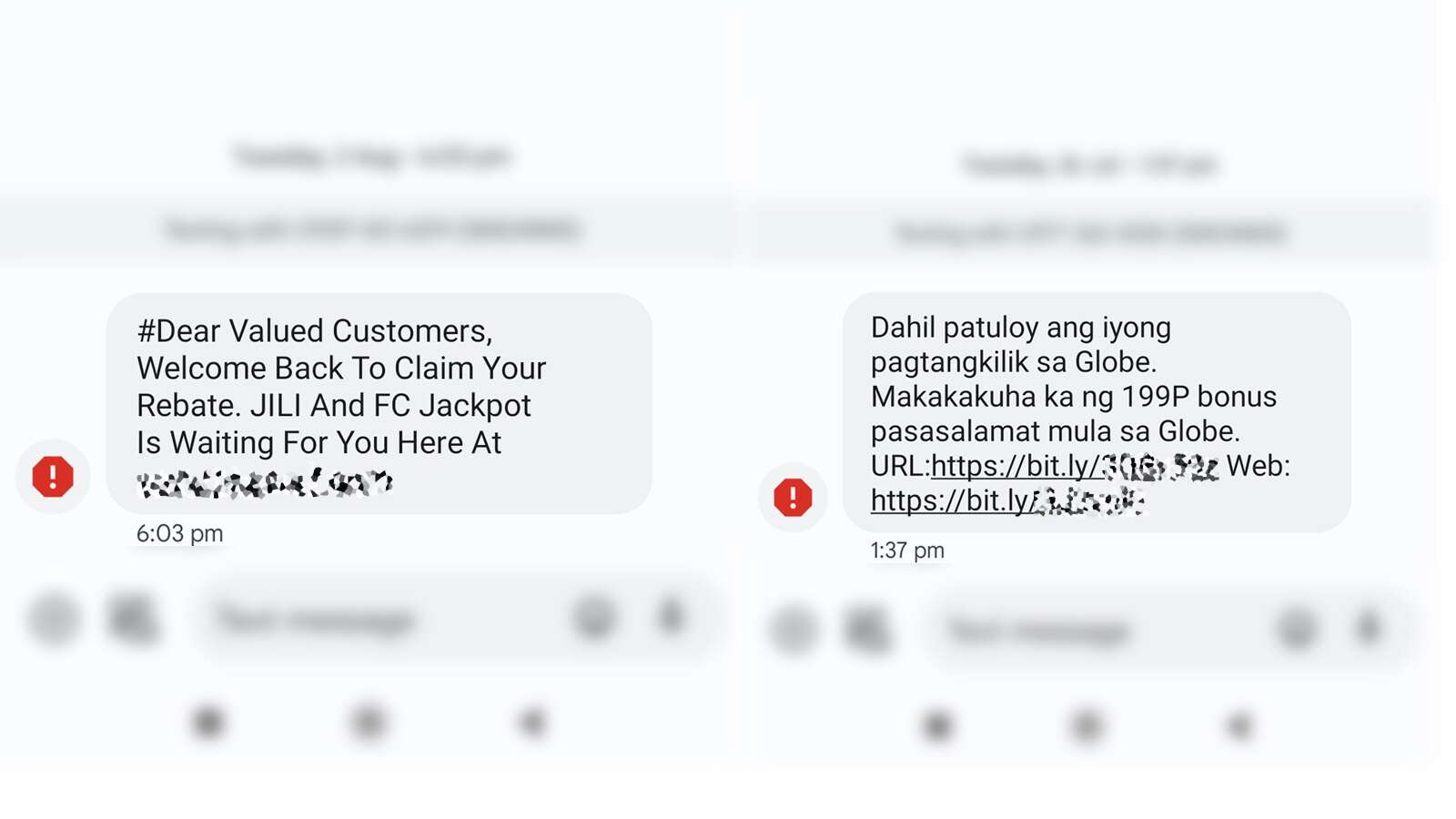

Text scams

Text scams involve receiving messages that may claim you have won a prize or are entitled to a refund or rebate. The scammers may ask for personal information or payment in order to receive the supposed prize or refund.

To avoid text scams, be cautious of unsolicited messages, never provide personal information or payment to an unknown sender, and verify the legitimacy of the message and sender.

Tech support scams

Tech support scams involve phone calls or pop-ups claiming to be from legitimate tech support, asking for remote access to your computer and demanding payment for services. Scammers may use fear tactics to convince victims that their computer has been infected with a virus or that their security has been breached. Victims may provide remote access or make a payment, only to find that their computer has been compromised or that the company does not exist.

Facebook link scams

Hackers may use social engineering tactics to trick you into clicking on suspicious links that may compromise your personal information or device. This is called clickjacking. Clickjacking is a type of online fraud where scammers trick you into clicking on something you didn’t intend to. This is typically done by overlaying a deceptive element, such as a fake button or link, on top of a legitimate website or application.

To avoid falling victim to hacking through suspicious links, be cautious of unsolicited messages or emails with suspicious links, only click on links from trusted sources, and verify the legitimacy of the link and sender.

Related: PROTECT YOUR FACEBOOK ACCOUNT: 6 TIPS TO PREVENT HACKING

Romance scams

Romance scams involve creating fake profiles on dating sites or social media, gaining your trust, and then asking for money. Scammers may use stolen photos and information to create a fake persona, which they use to lure victims into a relationship. Victims may be asked for money to pay for travel expenses, medical expenses, or other emergencies.

Romance scams can happen to anyone, but certain groups of people may be more vulnerable. According to the authorities, people aged 40 to 69 are more likely to fall for romance scams, with those aged 70 and older being the most vulnerable. Women are also more likely to be victims of romance scams, and scammers often target individuals who are divorced, widowed, or have a disability.

Furthermore, people who use online dating sites or social media platforms to find romantic partners may be at a higher risk of falling for these scams. This is because scammers often use these platforms to target their victims, creating fake profiles and pretending to be someone they’re not, which is more popularly called catfishing.

Rebate scams

Rebate scams involve scammers claiming you are entitled to a reimbursement or rebate from a government agency, bank, or trusted organization. The scammers may ask for an upfront fee or personal and financial information to receive the supposed rebate.

To avoid rebate scams, be cautious of unsolicited offers, never provide personal or financial information to an unknown sender, and verify the legitimacy of the organization offering the rebate.

@jgorpeza These so-called BPI agents were calling almost everyday. I answered them to know what they wanted and to end it. I was surprised they knew all my details and asked for 6-digit code (OTP) #scam #creditcard #phisingscam #beware ♬ original sound – Nice Garbo Orpeza

Protect Yourself from Scams

The best way to protect yourself from scams is to stay informed and vigilant. Here are some tips to help you avoid falling victim to a scam:

- Be skeptical of unsolicited messages or offers, especially those that seem too good to be true.

- Do your research before investing or making a purchase online, especially from unfamiliar sources.

- Be cautious of requests for personal or financial information, and only provide this information to trusted sources.

- Protect your personal information, such as your login credentials, and use strong, unique passwords for each account.

- Use security software and keep it up to date to protect your devices from malware and other online threats.

- Enable 2-Factor Authentication (2FA) on your online profiles if possible so that you’ll know when someone is attempting to access your account.

- Never provide your One-Time Pin (PIN). Your OTP is a unique code that serves as a security measure to protect your online transactions. Sharing it with someone else can give them access to your personal and financial information. Scammers often use various tactics to trick people into sharing their OTP, such as posing as a bank representative or creating a fake emergency scenario. Be wary of unsolicited calls, texts, or emails asking for your OTP.

- It’s important to never give out the CVC (Card Verification Code) of your credit card to anyone, especially to scammers. The CVC is a three- or four-digit code on the back or front of your credit card that is used as an additional security feature for online and over-the-phone purchases.

Scammers may try to convince you to provide them with your CVC by claiming it’s needed to verify your account or make a purchase. However, providing them with this information can lead to unauthorized charges on your credit card.

If you’re making a purchase online, make sure you’re using a secure website with a valid SSL certificate and look for the padlock symbol in your web browser’s address bar to ensure your information is encrypted.

If you suspect that you have been the victim of a scam, report it to the authorities and your financial institution immediately. By staying informed and taking the necessary precautions, you can help protect yourself from scammers and keep your personal and financial information safe.